Welcome to a new episode of my Dividend Diary on the TEV Blog. Here, I report the development of a cash flow-oriented investment approach that focuses on generating a passive income through dividends. Against this background, the goal is not to outperform the market but to put food on the table through a regular income via dividends.

As you know, I take care of my wealth management. To keep things simple, I have built three pillars:

- Active income.

- Passive income.

- Conversion.

Dividends fall into the last two categories. They are passive because I no longer have to work to receive the payments. Furthermore, they also contribute to the conversion because I reinvest the dividends and thus increase my passive income through dividends for the future.

My monthly dividend income in March:

This month I have received payments from the following companies:

- Johnson & Johnson (7.15 EUR)

- Archer Daniels Midland Co. (12.11 EUR)

- IBM (17.42 EUR)

- Snap-on (10.52 EUR)

- 3M (13.68 EUR)

- Unilever (20.13 EUR)

- Royal Dutch Shell (7.48 EUR)

- Realty Income (3.48 EUR)

- Qualcomm (10.17 EUR)

- Kontoor Brands (5.70 EUR)

- V.F. Corp (11.80 EUR)

- Novo Nordisk (12.60 EUR)

- Broadcom (12.92 EUR)

- Imperial Brands (14.00 EUR)

- PepsiCo (11.75 EUR).

The total dividend income in March(after taxes) was: EUR 170.91/appr. 200 USD

Dividend income check

Now let’s see how this month performed compared to the previous year. Last year, I received only EUR 133.81 in dividends in March, representing a 28 percent increase.

I am still struggling on the income side with the strong EUR/weak USD. But that’s just fine with me. Currently, I am in the phase of saving. Therefore, the strong EUR allows me to buy US stocks at a lower price.

So yes, it was a good start, and I look forward to the upcoming months. Will I set a new record with my “keep it slow and steady” investment approach? Well, probably. The development of my dividend income throughout the years is as follows:

Stock purchases for more dividend income

So back to business as usual. Last month, I bought shares in four companies and additional shares of one of my existing EFT holdings:

- Appen (100 shares)

- Palantir (35 shares)

- General Mills (12 shares)

- Ping An Insurance (100 shares)

- Teamviewer (18 shares).

In the following, I will briefly explain why I bought these companies. Please do not expect a fundamental analysis. I will only mention some aspects per company that might be of interest to the readers. Maybe you will find inspiration for your investment. In case you disagree, feel free to write your opinion about my purchases in the comments.

Right at the beginning of the month, I added shares of Appen and Palantir to my broadly diversified portfolio. Both investments carry the label “risky”. With Palantir, I have even invested in a company that is currently not yet profitable. I expect substantial price volatility here. With such stocks, we have to live with it if they lose 20 percent or even 50 percent of their share price after we buy them.

Data is the new fuel

One reason for the purchase of the two companies is their business model, which is mainly data-driven. Data is the new oil and is becoming increasingly important. 5G, in particular, will drive the demand for data ever higher. The problem in this area, however, is that data in itself is of no use.

Data only seen as a raw material is like the oil that is somewhere in the ground. We not only have to exploit it, but we also have to process it. That requires a lot of know-how. Companies with a strong market position can profit particularly enormously here. The sheer volume of data means that this requires the use of artificial intelligence. The market potential is enormous.

Appen and Palantir address these markets (very differently in each case). That’s why I made a move during the recent price weakness and built up initial positions.

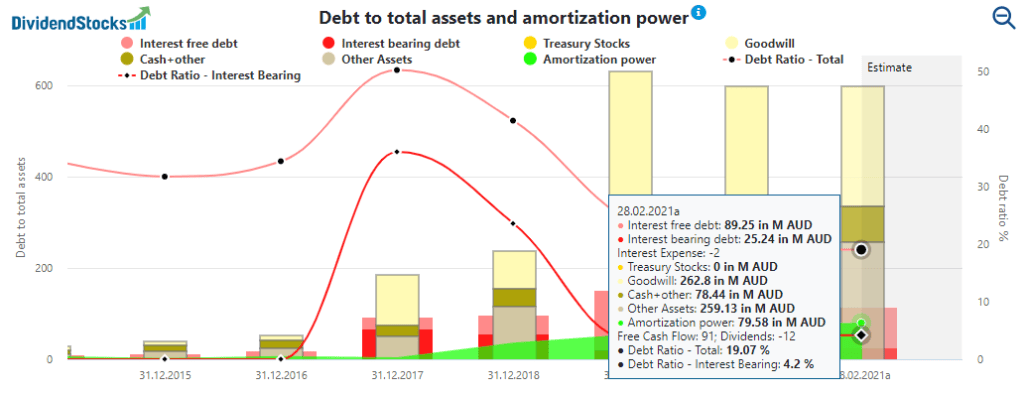

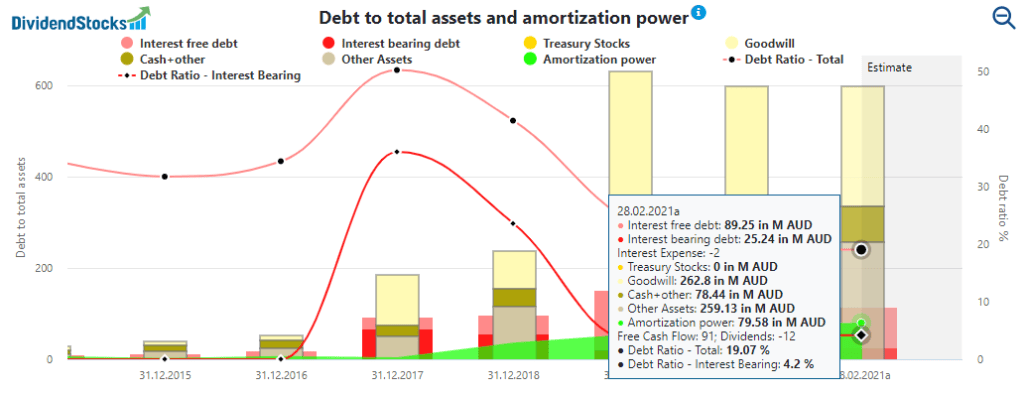

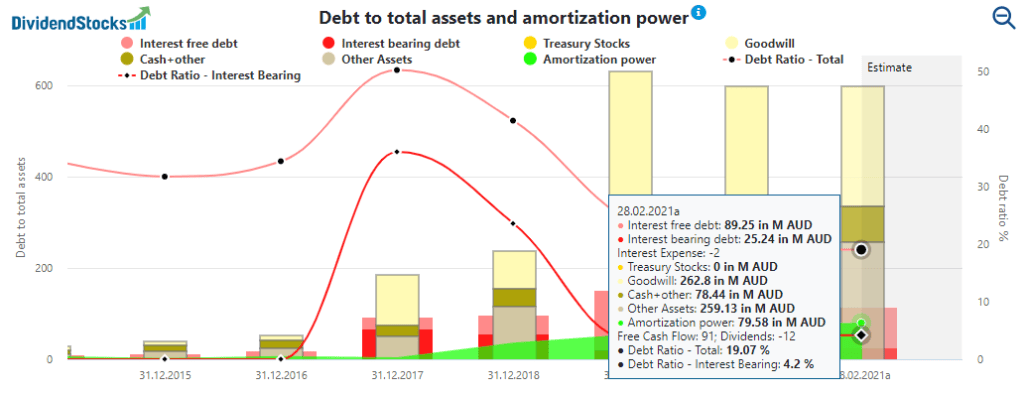

Appen

Appen is active in developing manually annotated datasets for machine learning and artificial intelligence. Here, Appen uses a large number of people to train the data.

Appen divides its business into two segments. The Content Relevance segment provides annotated data used in search technology to improve the relevance and accuracy of search results. On the other hand, the Language Resources segment includes data used in speech recognizers, machine translation, speech synthesizers, and other machine learning technologies, resulting in better and more easily controllable devices, including devices connected to the Internet.

The stock fell sharply following the 2020 half-year results. Corona has placed a considerable burden on Appen. Revenue and profit growth declined significantly. Appen commented on the results that the Corona pandemic caused customers to hold back their orders. Since the five largest customers (e.g., Microsoft and Amazon) carry 89 percent of sales, delayed orders from one customer could have a powerful impact.

The company expects growth to pick up again in the next few years. In this respect, this could only be a short-term weak phase, which I am pleased to take advantage of. Fundamentally, there is a lot of light now. Appen is practically debt-free. Together with the cash flow and profit, it can therefore invest well in further growth.

Besides, Appen even pays a dividend. Although the yield of 0.6 percent is somewhat low, the payout ratio of under 30 percent leaves room for further increases.

Finally, based on an adjusted P/E ratio of 30 and a price/revenue ratio of 3.25, the company is not expensively valued.

Palantir

Fun fact: Palantir is the only company in my portfolio that is unprofitable. But that is set to change because the company, like other younger growth companies in the tech sector, wants to break even sooner or later. How long this will take is not yet entirely clear but it might be that Palantir will be profitable by the end of 2021.

In the end, I’m not interested in exactly when the company will reach the break-even point. The main reason for my purchase was the company’s business model.

Palantir is engaged in the development of data integration and software solutions. It divides its business into the Commercial and Government segments. The Commercial segment provides services to private sector customers while the Government segment offers solutions to the U.S. federal and non-U.S. governments.

Palantir’s customers can use the solutions in various areas, such as automotive, financial compliance, legal intelligence, and mergers and acquisitions. Products include Palantir Gotham, Palantir Foundry, and Palantir Apollo.

The products enable government agencies and businesses to organize and make the best use of their data. For example, in a natural disaster, data can be analyzed to determine which parts of the population need what kind of protection or food. Customers can also use such solutions to investigate crime or fight terrorism. The potential applications are enormous, and Palantir shows robust growth, suggesting that their solutions match the huge demand.

I am aware that a Palantir share is currently relatively expensive, so it is not an anchor company for me. However, I have a foot in the door with my investment and will continue to follow the further development very closely.

I have written about General Mills many times as well. I recently published an analysis on Seeking Alpha in which I look at the latest quarterly figures. From my perspective, the company is back in the growth phase. My readers know that I assume cycles when it comes to consumer goods companies.

General Mills is at the end of a transformation process. We have seen before with Procter & Gamble and Nestlé that such processes take time and usually send the share price down. Those moments of doubts and impatience are the best opportunities for investors to collect shares.

[…]

After the substantial share price rises, Procter & Gamble and Nestlé no longer offer any real upside potential for the next few years. But other companies in the sector are going through similar cycles. Unilever and Danone are in the middle of it right now, and from my perspective, General Mills is at the end of this cycle.

Based on a reasonable adjusted P/E of below 17, General Mills offers an annual upside potential of nearly 5 percent through 2024.

This potential is not much, but it is stable, and the market may well price the company at a higher valuation in the coming years. In that case, the upside potential would be even higher. Yet, I was most attracted by the current high dividend yield of 3.3 percent and the prospect of further increases.

My last purchase was Ping An Insurance, which is the world’s largest insurance company. Below you’ll find a few reasons for my purchase.

Turning the spotlight on Asia

I already have an ETF for the emerging markets (Amundi Index MSCI Emerging Markets UCITS ETF DR (D). (You can find a more detailed description of the Amundi Emerging Markets ETF here). Nevertheless, given the current valuation levels, I would like to diversify my portfolio into other markets whose fundamental data is less lofty. The Chinese market is exciting in this respect.

How Ping An Insurance generates money

The company provides financial products and financial services. It operates principally through the following segments: Insurance, Banking, Trust, Securities, Other Asset Management, Technology, and Others.

- The Insurance segment provides life, property and casualty, annuity, and health insurance services.

- The Banking segment operates lending and brokerage, asset management, and credit card businesses.

- The Trust segment provides trust services and conducts investment activities.

- The Securities segment provides brokerage, trading, investment banking, and asset management services.

- The Other Asset Management segment provides asset management and financial leasing services and reflects the performance of the asset management and finance leasing businesses and the other asset management subsidiaries.

- The Technology operating segment provides financial and day-to-day services via internet platforms.

The company is similar to European insurance companies such as Allianz, but its business scope is even more extensive with its banking division. The outstanding thing about Ping An is the digital ecosystem that the company has created. This linked article gives a good first overview of Ping An’s business model and strengths (and weaknesses such as its geographically limited scope).

Valuation matters

As described above, I want to expand my portfolio geographically a bit, as the valuation levels on the western markets tend to be too high for me. Ping An fits nicely into the target focus as a pure-play Chinese company that is fundamentally highly cheap. It is interesting how profit and cash flow are continuously increasing, but the share price has not yet adjusted to the operational development.

Of course, the typical risks associated with investments in Chinese equities also come into play here. You should be aware of those. In addition to the sole focus on the Chinese market, it is primarily the risk of regulatory intervention by the Chinese government.

However, with the current undervaluation, the risk/reward ratio is currently good enough for me to invest.

Furthermore, the company pays a decent dividend with a yield of about 2.5 percent, which is expected to rise further in the future. The payout ratio of under 30 percent also promises further increases.

Again, TeamViewer? I know. My last purchases of the stock were in November, August, and February. Currently, I have 3.5 percent of my capital invested in that damn company.

Yes, I have already said everything about TeamViewer. For me, the company is one of the great opportunities in Industry 4.0 and IoT. It is still perceived as a simple remote and conference system company, which is misleading. The areas of application are much broader and pretty promising. With TeamViewer’s solutions, companies can access and control devices from virtually anywhere in the world or instruct other people to operate them.

Honestly, I didn’t want to buy any more shares after my last purchase for the time being. Then, TeamViewer announced that it would sponsor the Manchester United soccer club and the Mercedes Formula 1 team. It will spend 10 percent of its current annual revenue on these marketing deals per year.

Likewise, it has lowered its earnings outlook for the coming year due to those expenses. The news caused the share price to plummet. Currently, I am writing an extensive analysis about TeamViewer, which I will publish on Seeking Alpha. There, I will also discuss the reasons for these campaigns.

To make it short, I took advantage of the price declines and bought 18 more shares. Even with a very conservative fair value based on an adjusted P/E ratio of 30, there is still a massive upside potential of 15 percent annually over the next few years.

In the meantime, the company is one of my anchor investments, and I am curious to see how it develops. Nevertheless, it is likely to remain volatile for now, but that is fine. I am prepared to invest up to 5 percent of my portfolio in TeamViewer shares, so there is more room for further purchases.

Watchlist for April

Next month, there will be some additional purchases of shares. I am relatively flexible here. Either I buy new positions, or I increase my shares in existing investments.

The following companies are on my watchlist in particular:

- Hengan International

- Microsoft (MSFT)

- Digital Turbine (APPS)

- Intel (INTC)

- Salesforce (CRM)

- Mayr-Melnhof Karton AG

- SAP (SAP)

- Bayer

- Hugo Boss

- Sysco (SYY)

If you look at my report from last month, you will see that none of the companies I bought were on my watchlist. Why is that? Is the watchlist nonsense, and in the end, I only do what I want anyway? Yeah, a little bit. I don’t have a fixed system for my stock purchases, and that’s one thing I have to consider changing.

However, I have an extensive overview of many companies that I look at from time to time. The watchlist companies are primarily companies that I have currently examined particularly carefully, where substantial changes are imminent or which are in my focus for other reasons.

They are present to me in some form, which is why I put them on the list and perhaps monitor them a little more closely than other companies. But it often happens that I invest in different companies, after all. And so it happens that I buy other companies because it seems convenient at that moment.

Have you received dividends this month? What’s on your watchlist? Let me know and write it in the comments.

Did you like the article? Stay tuned for the following content… It is all entirely for free! Enjoy!

If you don’t want to miss any new articles, you can easily follow me on

or Twitter.

Sharing Is Caring

Your thoughts are too valuable to keep them to yourself. Make them available to the world and the community by sharing them with us. All you have to do is leave a comment after reading the posts on the blog. Just use clear writing and clear thoughts.

Hi. The idea with TeamViewer is very interesting. I am thinking of adding a small position to my portfolio tomorrow

Thanks for coming by Microscob! Indeed, TeamViewer is very promising. Here is just another example of a possible use case: LINK

Hi TEV, thanks for always sharing your progress with us. I’m particularly interested in how your Palantir investment will unfold in the long term.

Thanks Vic!

Palantir is indeed an interesting company and yes, its price depends on how we see them, as a software or as as consultant house. However, the business approach is unique in any case and worth investing.

I also have to admit that I enjoy listening to CEO Alex Karp.I don’t agree with him on many things, but his interviews are extremely thought-provoking. I look forward to following the further developments of the company as a shareholder.

All the best!