What is happening with the QuantumScape stock is symptomatic of several things at once. We see here once the extreme exaggerations in a market that many market observers consider overheated. The buying and selling activities are driven by emotions no longer have anything to do with an investment. Shares of QuantumScape are traded as betting slips, not as company shares. There is a good chance that many investors will run into a massacre.

Investor activity fueled by greed and fear

The share price performance in recent months reflected the greed and fear of investors.

The markets are overheated

In an overheated market, many shareholders are still trying to exceed the profits of others. Greed for even more profits is spreading. Added to this is the fear of winning less than the neighbor. And so investors pounce on the small caps. They buy every story and every promise.

But then comes the turning point

But then comes the turning point. It may be management’s announcement to issue more than 300 million new shares (note: according to an update, the purpose of the filing was to register shares for possible sale, and that nearly all the registered shares remain subject to lockup agreements). It may be an article that illustrates that much of what QuantumScape promises is technically almost impossible to achieve so far. Then the other side of greed and fear is revealed. Greed for profits suddenly becomes greed to maintain current status. Fear of missing out on gains suddenly becomes fear of losing everything. And so the emotionally driven herd sells. The only problem is that every seller needs a buyer. Where there are no buyers, the price falls.

We’re seeing such a process right now with QuantumScape

QuantumScape reminds me of the wildest times and stories of the tech bubble. We have a company with 0 (zero) revenue and an interim market cap of over USD 40 billion.

No product exists but a promise/vision: “solid-state lithium-ion batteries for electric cars”. Such a product brings many advantages compared to the currently used batteries but (and this is a really big but) such a product does not exist yet. This idea is enough to lift a company from 0 EUR to USD 45 billion market capitalization. So we have only one idea or at least a vision in which we invest. That brings me to the following point.

The QuantumScape stock reminds me of other carrots that have led investors into massacres

When I first heard about QuantumScape (sometime in November because of the IPO) it immediately reminded me of another vision.

I am talking about Energous

Energous stepped up to charge everyday electrical devices via the air (yes, really via the air). How awesome and promising is that? Well, this is how the company described itself back in those days:

Energous is leading the next generation of wireless power and wireless charging with WattUp® […]. WattUp® is an award-winning technology that will transform the way consumers and industries wirelessly charge and power electronic devices at home, in the office, in the car and beyond. WattUp differs from older wireless charging systems because it supports power at-contact, as well as at-a-distance, enabling a charging ecosystem that frees users from always having to actively charge or manage batteries.

Energous Corporation has developed WattUp®, a groundbreaking RF-based charging technology that will fundamentally change the way you think about charging your portable electronic devices. The WattUp wire-free charging system delivers energy over the air in your home, office, car or practically any other space you can imagine via a contained energy pocket. Mobile, wire-free power management means freedom from cords or stationary charging pads, and the potential freedom from worrying about running out of battery life altogether.

Sounds great, right?

That’s what Energous’ promises looked like, and investors believed those promises

Source: Webpage

Source: Webpage

Source: Webpage

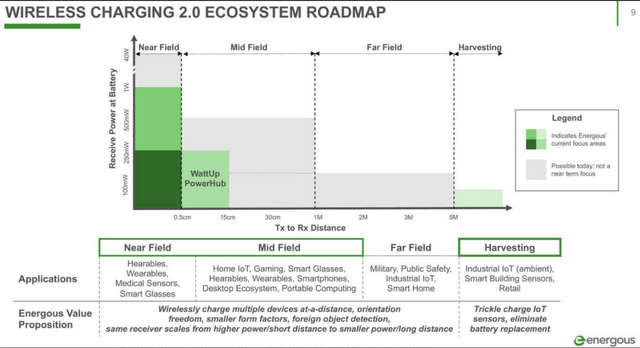

All of that was a few years ago. In the meantime, Energous sees itself as a company with a completely different focus. As you can see below, Energous’ focus is no longer at all on what it always wanted to achieve. There is a business case somewhere but compare that again with the announcements above.

Source: Presentation

Back then, too, the hype was great. Dialog Semiconductor, a supplier of Apple and Samsung, had invested massively in the company without ever reaping harvesting any fruits. And so the Energous share gradually sank into nothingness.

The betting slip analogy

What exactly is the reason for such breakouts in companies’ share prices (Energous or now QuantumScape)? Sure, emotions explain the incentive investors have to buy and sell. But why do they invest in such companies? From my point of view, it has nothing to do with investing, but with speculating. If it were only about investing, investors would continue to buy now. Still, they do not buy aggressively (in the majority). And that is why the share price continues to fall. This development reminds me of my betting slip analogy, which I recently explained in more detail here on Seeking Alpha:

Behind this purchase decision was simply the expectation that the price will rise. For me, who wants to become an owner of companies and therefore wants to get a substance for his money and not just a coupon that might increase in value, this consideration was new. In this respect, the perspective has changed. A share is no longer the proof of ownership of a company but a kind of betting slip with which one can bet that share prices will rise. With this change in perspective, the focus has shifted significantly from investing to speculating.

I think it’s perfectly okay for people to speculate. The stock market is open to all investors. But the problem I have (and of which I was not aware for a long time) is that the line between speculation and investing is not at all transparent for many investors. So let me be clear: QuantumScape is a bet with a too unclear outcome and very unfavorable odds. Why is that? I will explain that in more detail in the next point.

Outlook

From my point of view, the outlook is relatively poor. QuantumScape is one of several companies (besides amprius) that wants to design new innovative batteries for the EV market.

Can QuantumScape even do what it claims?

In another article, a much more technically savvy analyst drew the following conclusions:

Given their success so far and their access to capital, I do think QuantumScape will succeed in getting a battery to market. However:

- It will have lower energy density than Amprius has achieved today.

- It will likely first show up in watches and wearables, then maybe phones.

- It will take much longer and cost much more to scale than they think.

- It will not be able to withstand the aggressive automotive environment.

- It will be far more expensive than today’s lithium ion batteries, and will likely never achieve lower cost than contemporary lithium ion batteries.

- Once a suitable cell size is made, it may not be any safer than today’s lithium ion batteries.

Of course, we must take into account that the author is the CEO of a battery company. Does that give him credit or does it bias him? We can’t say that to normal investors. We have much less idea than he does. The risk of cognitive bias is therefore extremely high.

Taking a look at the filings

What we know for sure it that QuantumScape is still very far from creating a product and also points to this (but investors have to read it):

We face significant barriers in our attempt to produce a solid-state battery cell and may not be able to successfully develop our solid-state battery cell. If we cannot successfully overcome those barriers, our business will be negatively impacted and could fail.

Our relationship with Volkswagen is subject to various risks which could adversely affect our business and future prospects. There are no assurances that we will be able to commercialize solid-state batteries from our joint development relationship with Volkswagen.

Producing lithium-metal solid-state batteries that meet the requirements for wide adoption by automotive OEMs is a difficult undertaking. We are still in development stage and face significant challenges in completing development of our battery and in producing battery cells in commercial volumes. Some of the development challenges that could prevent the introduction of our solid-state battery cell include difficulties with increasing the yield of our separators and single-layer cells, multi-layer cell stacking, packaging engineering to ensure adequate cycle life, cost reduction, completion of the rigorous and challenging specifications required by our automotive partners, including but not limited to, calendar life, mechanical testing, and abuse testing and development of the final manufacturing processes.

Is the Quantumscape stock a fraud?

The extent to which the recent allegations concerning possible violations of federal securities laws are valid may therefore be doubted. The same applies to the accusation of fraud. The company says relatively openly that it doesn’t know if it will ever reach its goal. Nevertheless, those allegations will now exert further pressure on the share price. Given these uncertainties (which remind me so much of Energous), the current market cap is way too high. It is still almost one-fifth of Volkswagen.

Besides that, you should think about other points. The cooperation with Volkswagen has been in place since 2012, and the money Volkswagen invests in QuantumScape is peanuts since the German automaker generates approximately EUR 200 billion in sales per year. EUR 200 million is below 0.1 percent of that annual revenue. Thus, we have no reason to assume that QuantumScape has reinvented the wheel.

QuantumScape is not the only one

Investors must also remember that completely different companies are eyeing the market. Apple is one example:

As for the car’s battery, Apple plans to use a unique “monocell” design that bulks up the individual cells in the battery and frees up space inside the battery pack by eliminating pouches and modules that hold battery materials, one of the people said.

Apple’s design means that more active material can be packed inside the battery, giving the car a potentially longer range. Apple is also examining a chemistry for the battery called LFP, or lithium iron phosphate, the person said, which is inherently less likely to overheat and is thus safer than other types of lithium-ion batteries.

Sounds familiar? It would be naive to assume that QuantumScape has an advantage or head start here. All the more reason to ask what exactly justifies the high valuation here. All the more, it becomes clear what QuantumScape is. A betting slip.

Conclusion

QuantumScape reminds me of dark times. IPOs (or SPACs) are bought without there even being a hint of revenue or any product at all. The vision alone is enough to lift companies to insane market capitalizations. There’s nothing wrong with investing in stories like QuantumScape. However, investors should not forget that these are high-risk bets. That is why companies like Volkswagen or Bill Gates only put very little money into such companies. Investors should also maintain the rule of diversification.

I would never put more than 0.5 percent of my capital into a company like QuantumScape. If such a company becomes a ten-bagger, then 0.5 percent becomes 5 percent. Well played in that case. If the company goes under, I lose just 0.5 percent of my capital invested. In the end, it must always be an investment scheme that limits your risk and only then looks at the opportunities. This is how wealth management works.

Invested investors who have only speculated should hold the shares. Volatility in such stocks is common. The recent upward movements of QuantumScap’s share price after the crash have shown that. Other investors who really wanted to invest should be aware of the risk and consider selling, especially after the last share price increase. The comparable investment case of Energous has shown what can happen with such hyped stocks without real substance in the long-term.

If you don’t want to miss any new articles, you can easily follow me on

or Twitter.

Sharing Is Caring

Your thoughts are too valuable to keep them to yourself. Make them available to the world and the community by sharing them with us. All you have to do is leave a comment after reading the posts on the blog. Just use clear writing and clear thoughts. You can also share this post with your favorite network: