Welcome to a new report of my Dividend Diary on the TEV Blog. Here, I report the development of a cash flow-oriented investment approach that focuses on generating a passive income through dividends. Against this background, the goal is not to outperform the market but to put food on the table through a regular income via dividends.

With the Dividend Diary, I document how a cash-flow investment approach can be part of well-balanced wealth management. To keep things simple, I have built three pillars:

- Active income.

- Passive income.

- Conversion.

Dividends fall into the last two categories. They are passive because they provide a cash flow without me going to work. Additionally, they are an essential pillar for conversion since they can be reinvested to generate even more income in the future. That is the Theory. Now let’s get down to practice.

My monthly income with dividends in January:

This month, my cash-flow approach generated the following income through dividends:

- MSCI World Energy ETF (55.22 EUR)

- Automatic Data Processing (22.72 EUR)

- Best Buy (14.01 EUR)

- Kimberly-Clark Corp. (25.24 EUR)

- Iron Mountain (16.56 EUR)

- PepsiCo (19.76 EUR)

- Merck & Co. (20.86 EUR)

- Altria (24.25 EUR)

- Leggett & Platt (34.20 EUR)

- Realty Income (18.96 EUR)

- Main Street Capital (8.79 EUR)

- Alexandria Real Estate (14.39 EUR)

- Balchem (4.28 EUR)

- Cisco (26.32 EUR).

The total monthly income with dividends in January (after taxes) was: € 305.56 / appr. $ 330

Dividend income report check

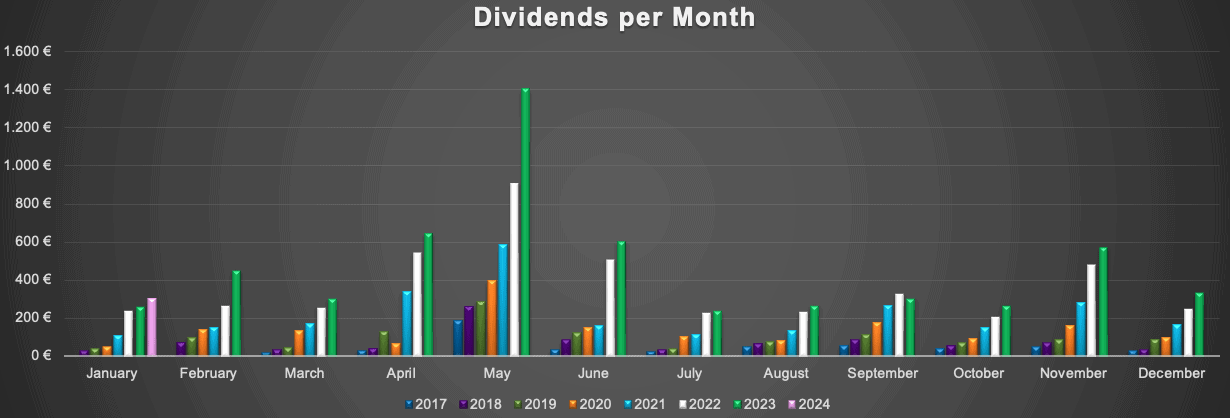

January is traditionally one of the months with the lowest dividend cash flow. Nevertheless, compared to last year, the performance was okay (+ 15 percent YoY). Overall, the development looks like this:

Stocks I sold in January

I sold all of my shares in Fresenius and Fresenius Medical Care due to their lack of performance, the dividend cuts, and the challenging environment for these companies.

Stock purchases in January

I added 23 shares of Amdocs Limited to my dividend portfolio.

I also bought more shares of great companies via my already existing automatic investment plans:

- AbbVie

- Amdocs (newly initiated in January)

- Alexandria Real Estate REIT

- Automatic Data Processing

- Bristol-Myers Squibb

- Cboe Global Markets

- CVS Health

- Diageo

- Extra Space Storage

- Emerging Markets ETF

- Generals Mills

- Japan ETF

- Kontron (newly initiated in January)

- Mensch & Maschine

- PepsiCo.

- Pfizer

- Realty Income

- Snap-on

- Qualcomm

- Williams-Sonoma

Cisco Systems(paused in January)General Dynamics(paused in January)IBM(paused in January)Henkel(paused in November)Mayr-Melnhof Karton(paused in December)Siemens(paused in December)Stemmer Imaging(paused in January)USU Software(paused in January)Unilever(paused in November)Valmet(paused in December).