In this exclusive article for the TEV blog, I will present three defensive stocks for your portfolio. They act as anchors and give your portfolio security in turbulent times. You can then sleep in peace while the stock markets around you sink into chaos. Besides, these companies also provide you with reliable cash flow.

If you don’t want to miss the new TEV Report or any other new articles or analysis, you can easily follow me on

or Twitter.

Three companies in turbulent times

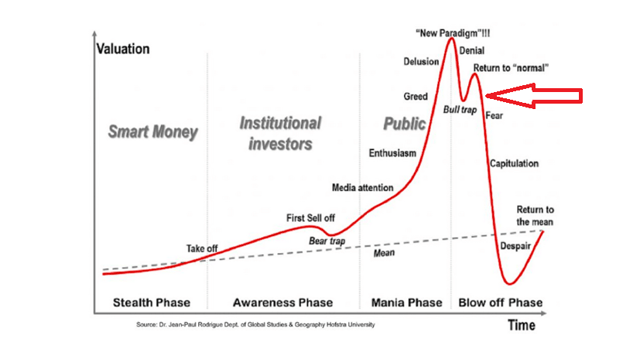

Private investors are currently in an extremely turbulent time. The exact future of the stock markets is difficult to predict. Will it come to a V-shaped bull market, or will it continue to go down? There are parallels to a typical course of big bear markets.

As always, nobody can predict the future. Therefore you should not panic. Do not think about things you cannot influence! Instead, invest in defensive stocks that give your portfolio security and let you sleep soundly.

In the following, I would like to introduce three highly defensive stocks in more detail and present some key figures. These are the handpicked companies:

- Johnson & Johnson

- Kimberly-Clark

- Microsoft.

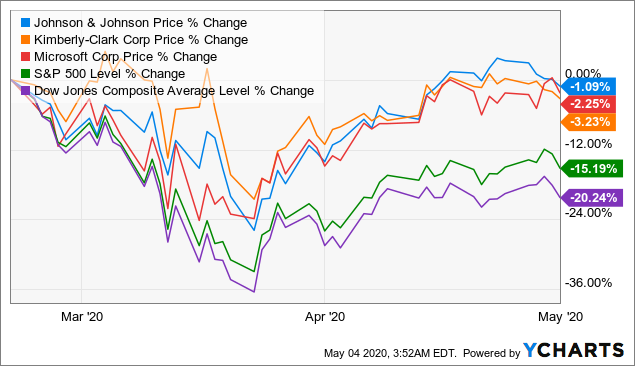

Since the outbreak of COVID-19 induced volatility in the markets, these companies have performed outstandingly. While the S&P 500 and the Dow Jones simmer in double digits, the three companies have hardly lost any value.

Johnson & Johnson

Johnson & Johnson is a globally active and multinational company in the field of health care products and medical devices. The product range includes such well-known and renowned brands as Penaten Creme or Neutrogena Shampoo, as well as health care products.

Johnson & Johnson has grown enormously in the last decades and has given its investors much pleasure. Smart acquisitions, long-term thinking management, and excellent R&D have given the company an extremely defensive framework.

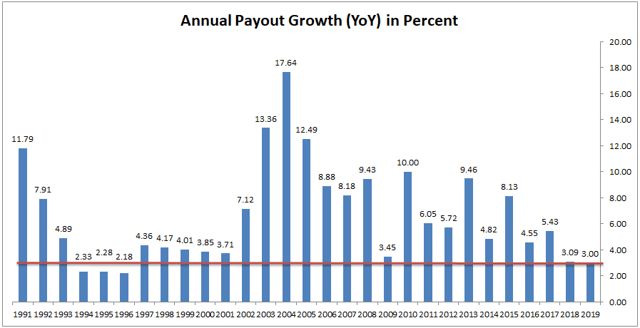

The TEV Dividend Dashboard also shows the green light. Johnson&Johnson has now increased the dividend every year for almost 60 years in a row. The current yield of 3 percent is okay. The payout ratio is excellent at around 50 percent. Indeed, the times of double-digit dividend increases are over. But mid-single-digit increases are a good thing in the current market environment.

In terms of a fundamental valuation, Johnson & Johnson is with a forward P/E ratio of 19 not cheap, but at least below its 5-year median.

Kimberly-Clark Corp.

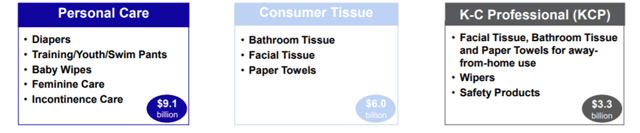

Kimberly-Clark is a company in the paper/pulp sector. According to the company, 25% of all people in the world use a company product at least once a day. The company produces strong brands such as Huggies, Kleenex, and Scott.

(Source: Investor presentation)

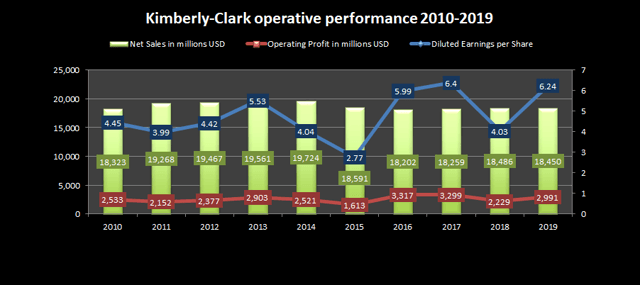

Kimberly-Clark is also a highly defensive company. Although it struggled to grow for a while, it seemed that the company was getting things back under control and returning to growth.

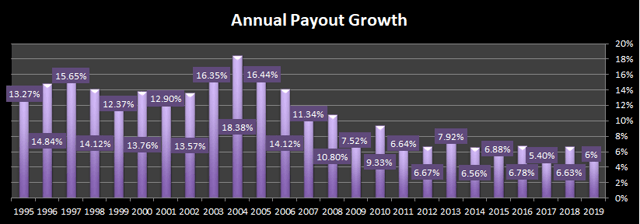

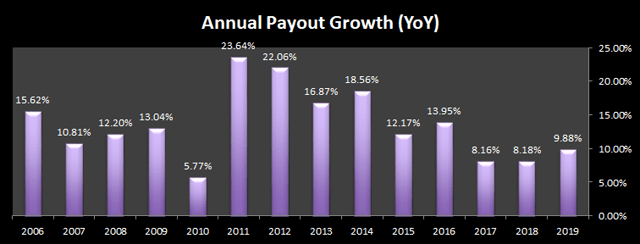

COVID-19 could slow down the new momentum a bit. On the other hand, demand for Kimberly-Clark hygiene products was particularly strong. The market also seems to regard the company as particularly strong in the current crisis. The TEV dividend dashboard also gives Kimberly-Clark the green light. The yield here is even over three percent, and the payout ratio is similarly good as at Johnson & Johnson. Only the annual increases are relatively low and are not expected to be significantly higher soon due to uncertainties and possible economic downturns.

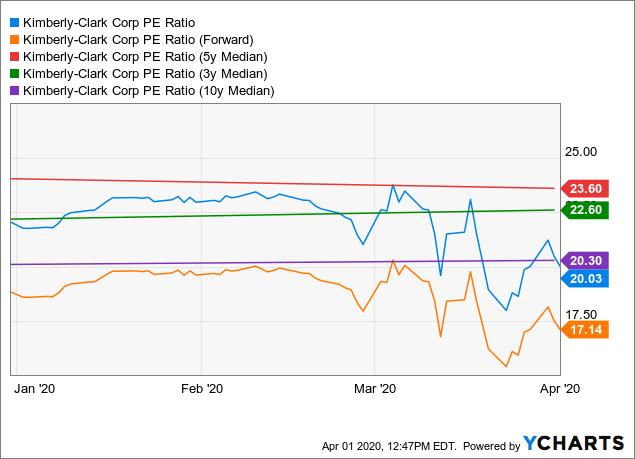

Fundamentally, Kimberly-Clark is reasonably valued. But the shares are not cheap. With a price/earnings ratio of 20, the company is in its historical range, but a lower P/E ratio would be nicer for an investment. But if the stock markets continue like this, investors will have to wait a very long time for such a moment. Looking at the forward P/E ratio, however, the situation looks somewhat better.but investors must then take into account that they are pricing in further growth despite COVID-19.

In my last Seeking Alpha analysis about Kimberly-Clark, I wrote the following about Kimberly-Clark, which I think sums up the company perfectly:

Kimberly-Clark is an extremely stable and reliable company. It is certainly not an exciting growth story. But in volatile times like these, the advantages of such companies become apparent. They are price stable and defensive. This gives investors security. Furthermore, the programs launched to increase productivity and cut costs are beginning to show their first effects. In addition, the company pays its dividends reliably. In times like these, investors (myself included) should appreciate such companies more.

Microsoft

Microsoft Corporation is a global leader in the software industry and is considered the pioneer of the personal computer with its Windows operating system. In the meantime, it is also one of the most significant players in the cloud segment.

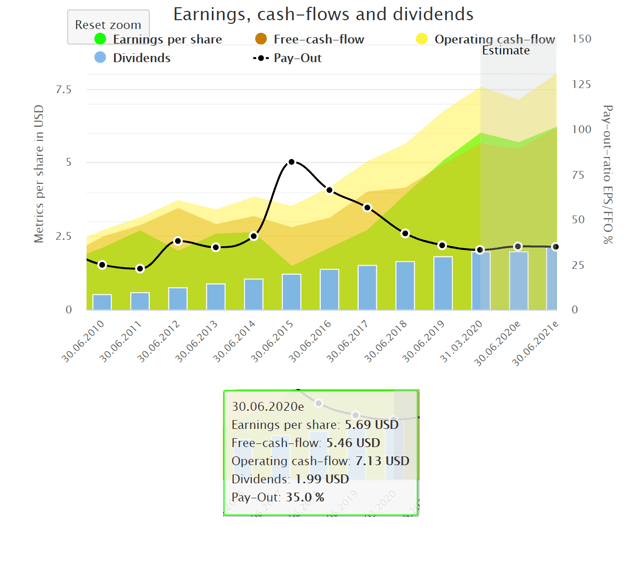

In a portfolio that would only consist of the three companies, Microsoft would be the growth engine. Cash flow and profit have grown extremely in the last five years. The conversion of the Office package to subscription models and growth in the high-margin Cloud segment were the main reasons for the success of Microsoft shares.

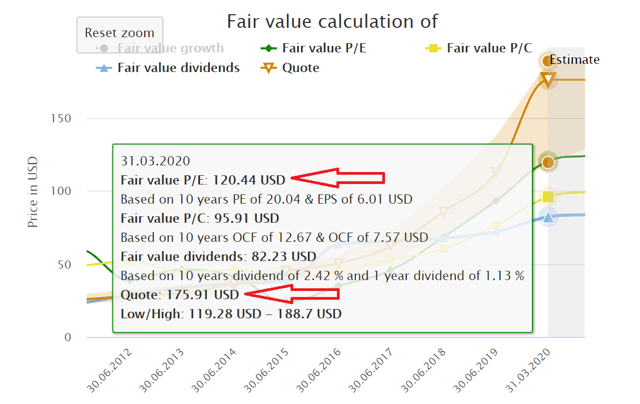

(Source: Dividendstocks.cash)

As is so often the case with growth companies, the dividend yield is relatively low. On the other hand, the payout ratio still offers sufficient leeway for continued high dividend increases.

Investors have to take into account that Microsoft is extremely highly valued. The difference to the actual fair value based on the P/E ratio of the last ten years reveals downside potential.

(Source: Dividendstocks.cash)

In my previous Seeking Alpha analysis about Microsoft, I wrote the following about Microsoft, which I think sums up the company perfectly:

In view of Microsoft’s business model, share price development, and dividend history, it could, therefore, become increasingly clear that Microsoft also bears important characteristics of a defensive investment. This consideration also influences how particularly risk-averse investors can invest in Microsoft. Since defensive companies are less vulnerable to crises, it makes sense to always invest in Microsoft in small tranches in order to take advantage of the cost average effect. It is equally reasonable not to trade these companies, but simply to leave them in the portfolio and continue to buy when prices fall back.

Conclusion: Defensive Stocks Come With A Premium Price

Defensive anchor stocks let you sleep peacefully. However, you have to pay a high price for such a luxury. Nevertheless, the market wants to tell you that these companies are relatively safe and have a stable business model. By using the cost average effect and investing in several companies at the same time, you can hedge a possible downside risk relatively well. Besides, there’s one thing you shouldn’t forget: Who knows if such stocks will ever fall significantly low again? If you are convinced of a company and want to invest for the long term, then just stay invested and let time work for you. It is better to accompany the company through another valley than to miss the next summit.

Now it’s your turn to do your due diligence

Has a company caught your interest? Then it’s time for your own due diligence.

The Internet offers you excellent opportunities in this respect. I write many analyses here in the TEV Blog. Just take a look at the category “Analyses” or click here. Maybe you already find something. You can also ask the community in the comments if they can help you with your due diligence.

Otherwise, I use tools like those from Dividendstocks.cash and Seeking Alpha to do further research. You can also find me and my analyses on these platforms.

Did you know? Sometimes you need a lot of patience until an investment pays off and you achieve wealth and prosperity. There are many examples of companies that have already lost 30 or even 50 percent of their value in just one day. In the end, they have nevertheless generated more than 1000 or even 100,000 percent return. Therefore:

1. Don’t be greedy.

2. Be patient.

3. think long-term!

–> Click here for my article 4 Stocks That Crashed Badly Before They Brought Wealth And Prosperity <–

Did you like the article? Click here for more and stay tuned for the following content… It is all entirely for free! Enjoy!

If you don’t want to miss any new articles, you can easily follow me on

or Twitter.

Sharing Is Caring

Your thoughts are too valuable to keep them to yourself. Make them available to the world and the community by sharing them with us. All you have to do is leave a comment after reading the posts on the blog. Just use clear writing and clear thoughts. You can also share this post with your favorite network: